There are several different systems, through which a refund can be processed (gateway, shop module, etc.) and the processing time for each of these systems varies. Some request refunds right away and some request them hourly or daily.

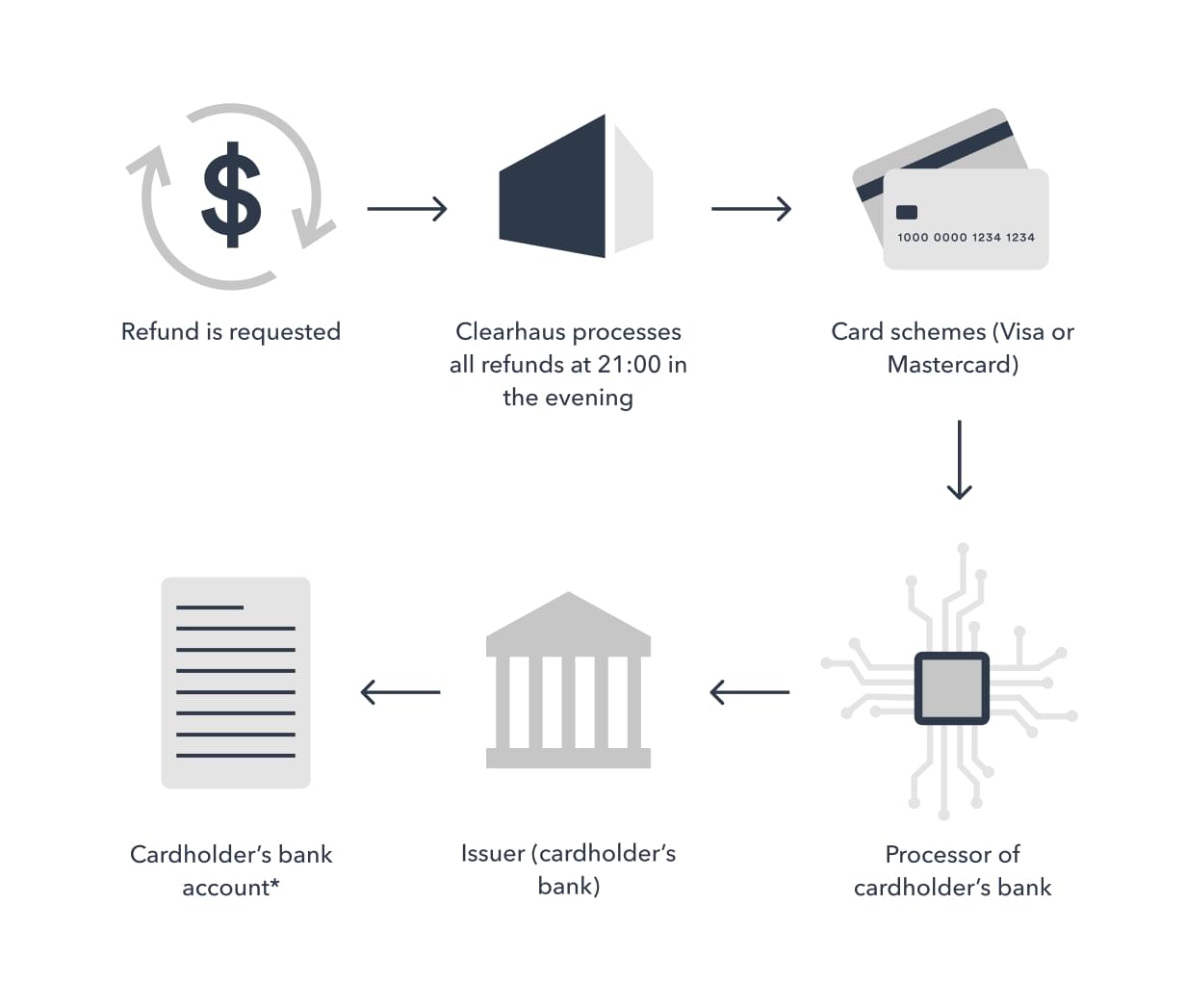

Before the refunded money arrives to the cardholder’s bank account, a refund goes through a number of steps. These steps may vary depending on which system is used to process the refund, but most often the process looks like this:

*Be aware that it is the issuing bank that chooses when the money is transferred to the cardholder’s bank account.

Refunds normally take 2-5 days - but can take up to 10 days.

Unfortunately, the process cannot be sped up.

If you log in to your Clearhaus dashboard, click on the refund you have made, and look under “details”, you can see an ARN number (this number will be shown the day after the refund). This is a tracking number, which can be given to your customer so that they can give this number to their bank, in order to track the money.

Yes, you can. Your current gateway and future gateway can exchange data, and make sure your payments will continue to run smoothly even when changing from one PSP to another PSP.

You should inform your current and future PSP regarding this, and ask them to get in touch with eachother, so they can solve it together.

| Symbol | Meaning |

|---|---|

| Apple Pay - the payment was made using Apple Pay | |

| Google Pay - the payment was made using Google Pay | |

| Card - the payment was made using a credit/debit card | |

| Tokenization - the payment was made using a token | |

| MobilePay Online - the payment was made using MobilePay Online |

| Flag | Meaning |

|---|---|

| F | Fraud |

| S | Settled |

| R | Recurring |

| 3DS | 3-D Secure Full |

| 3DSA | Attempt for 3-D Secure |

Tip: You can search for transactions containing different flags. For example, you wish to search for transactions marked as “Fraud”. To do this, you search for “Flag:F”, and the transactions will appear in the transactions-list below. You can search for transactions marked as “Recurring” by typing “Flag:R”, and so on.

Status code 40410 exposes that the transaction was “Declined by issuer or card scheme”, which can mean two things.

One explanation is, that the card scheme (i.e. Visa or Mastercard) declined the transaction , but this happens very rarely.

The other possible explanation to why the transaction was declined is that the issuing bank decided to decline the transaction. This means that the cardholder’s own bank declined the transaction. This could happen for several reasons, but the issuing bank does not normally pass an explanation to Clearhaus for these declines.

Pro tip: In these cases, should you be interested in knowing why the issuer decided to decline the transaction, we recommend that you ask your cardholder to get in touch with their bank and ask for an explanation.

A retrieval request occurs when a credit card issuer or the cardholder asks a merchant for a copy of a transaction ticket. The request most often occurs when cardholders lose their copy of a transaction and need it for their records, or when questioning a transaction. The fee will occur whenever a cardholder does a retrieval request at their issuing bank.

Pro tip: If you wish to minimize the chances of receiving a retrieval request, it’s recommeneded to implement several things:

The exchange rate/exchange fee/FX-rate, is applied when an authorization is processed in another currency than the merchant account is originated in.

For example, a cardholder tries to buy a couple of shoes valued at €100, but when they check out, they pay in USD ($) instead of EUR (€), and the merchant account is receiving EUR from Clearhaus, then Clearhaus will exchange the USD to EUR, which makes the transaction subject for this fee.

Clearhaus can do credits (payouts to cardholders’ Visa & Mastercard) in all the currencies supported by Visa & Mastercard - you can see all the currencies they support here.

For example, if a cardholder is from Croatia, and has requested a payout to their card, Clearhaus allows you to send the funds directly from your merchant account to the cardholder, in the currency the cardholder wishes - this does not depend on what currency your merchant account is in.

This response code means that the cardholder has blocked your online shop from deducting money on their card at any time - this applies to both recurring transactions and regular one-time payments.

Tip: If you see this status code, you should be worried since the cardholder is obviously unhappy with you and your service. In such cases, Clearhaus recommends that you do your best to get in touch with the cardholder to investigate what has happened and why the cardholder is unhappy. We advise that you do everything you can to solve the dispute between you and the cardholder.

Clearhaus offers several settlement currencies, but we cannot change the settlement currency on your current account. Instead, if you wish to change your settlement from i.e. EUR to GBP, you need to submit a new application. We will then give you a new account, MID-number, and API-key, enabling you to split your traffic between EUR and GBP.

Tip 1: Instead of starting from scratch with a new Clearhaus application, you can clone your initial application, saving you some work. How to clone an application:

Tip 2: Clearhaus charges an exchange fee when you receive a transaction in another currency than your settlement currency. For example, if your settlement currency is EUR, but you receive a transaction in USD, an exchange fee will be charged when the payment is processed. Therefore, if you receive many different currencies on your website, you should consider creating several settlement accounts in different currencies so you can save the exchange fees.

Yes, it is possible to request a change of your settlement frequency, but Clearhaus’ risk and support team will evaluate your request and has the option to turn it down. Often it will be possible to change from daily to weekly payouts and from weekly to monthly payouts.

To request a change in settlement frequency, please get in touch with the support team by sending a mail to support@clearhaus.com.

To invite someone to your my.clearhaus platform, you should follow these steps:

Tip:

Note: Your API-key should only be shared with people you trust since it contains your company details.

When an online shop makes an authorisation, the relevant amount is reserved on the cardholder’s account. When this amount is withdrawn from the cardholder’s account, the reservation is usually removed - normally within a day. Sometimes it takes a bit longer before the reservation is removed.

After an authorisation has been approved and the amount has been reserved, you (the online shop owner) can cancel the transaction by making a void.

In some cases, an authorisation is rejected with an error code. If this happens, you make a new authorisation that you can make a capture on when you send the goods. When an authorisation is rejected with an error code, the reservation is not always removed immediately. If this happens, you can send a confirmation to your customer, proving that you have received your payment and that the reservation should be deleted. The customer will then be able to go to their bank and ask them to remove the reservation.

A reservation is usually removed after 1-2 days, but sometimes it takes up to 7 days. Some banks even take 30 days to remove a reservation.

In my.clearhaus.com, you can see that the “exchange fee” isn’t included. This is because we deduct the exchange fee before we deduct our processing fees.

Calculation example:

Original amount: 470.35 USD. Card type: Mastercard Date: 21st of May 2018 Mastercard’s exchange rate at that specific time for USD to EUR: 0.851215 Amount when exchanged from USD to EUR using Mastercard’s exchange rate: 400.37 EUR The new amount will be: 397.97 EUR after we have deducted the exchange fee.

When you do a refund, you can check the status code in dashboard. If the refund has the status code 20000 (approved), the money has been paid out by Clearhaus. It can take up to 10 days before the customer will receive the money in his bank account.

Tip: To provide great customer service, take a screenshot of the specific, approved transaction from my.clearhaus.com. To do so, click the specific Transaction ID and the related transactions will appear. You can take a screenshot that shows that the refund has been approved. You can also send your customer the “ARN” - this can be found on the specific transaction. With the ARN, the customer can contact their own bank and ask them to investigate the refund. Hopefully, the bank will be able to locate the money and let the customer know when the money is expected to be in their account.

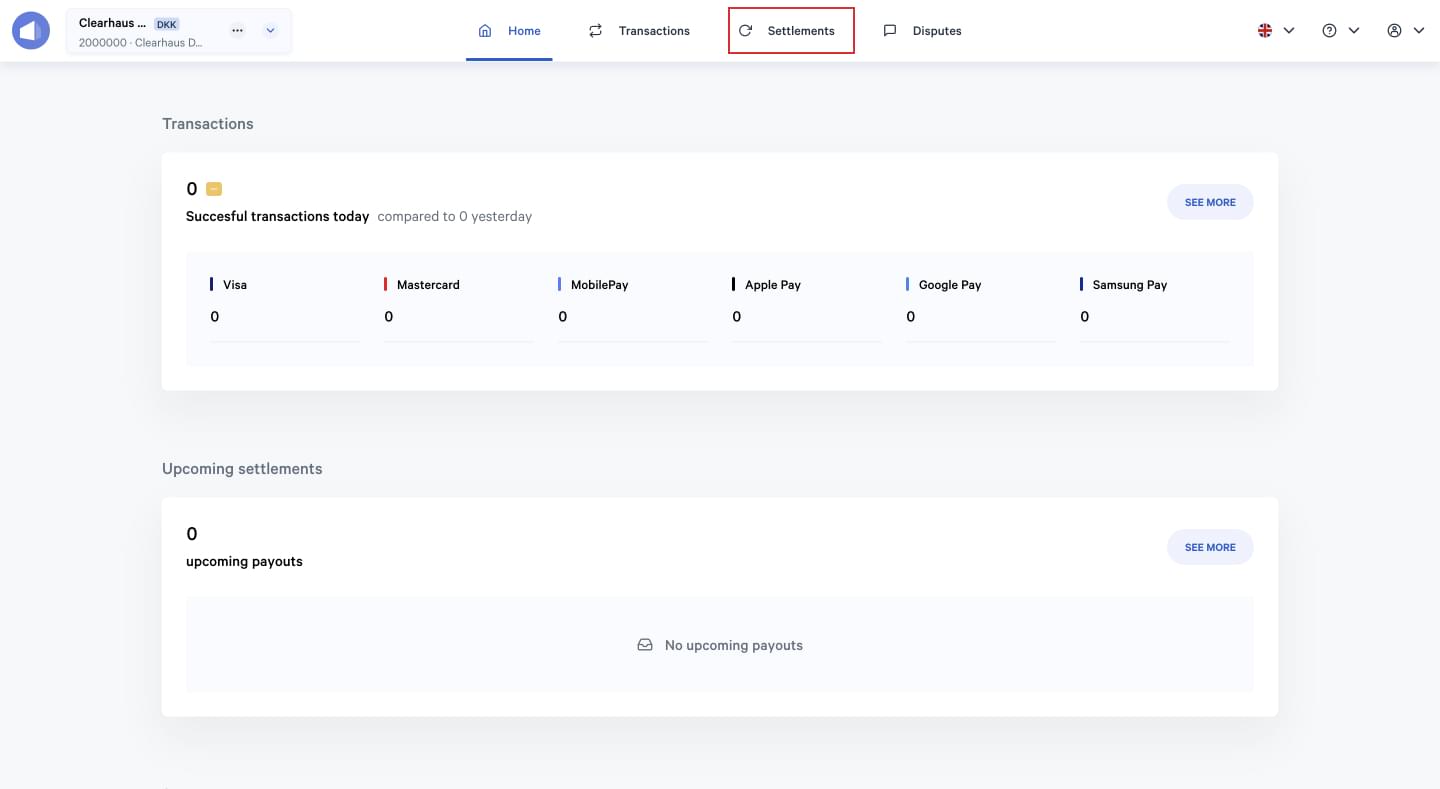

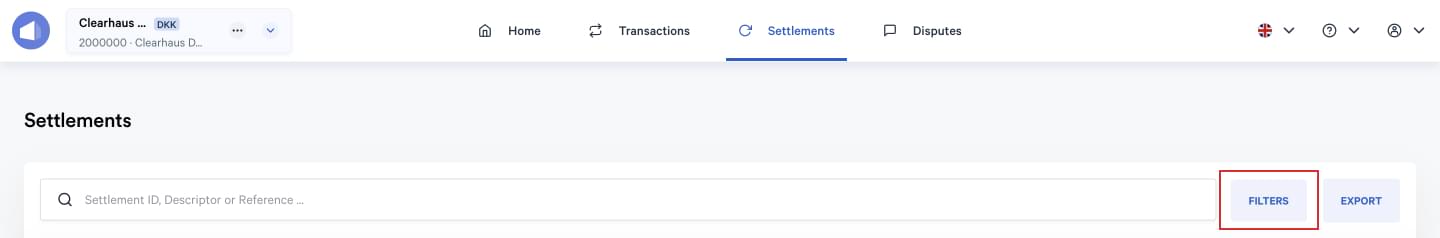

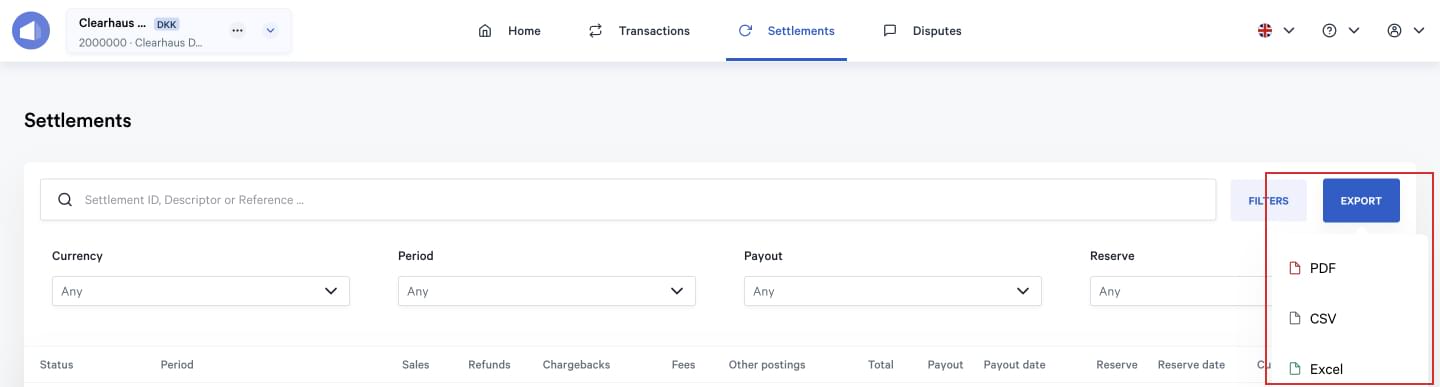

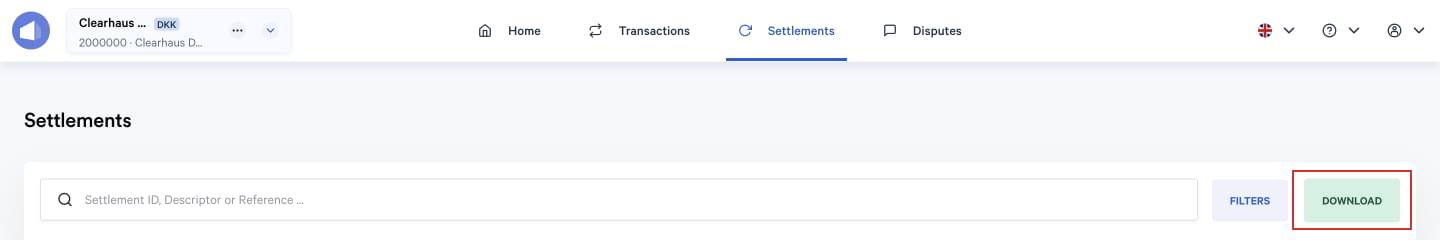

You can always go to my.clearhaus.com to see a breakdown of the charges. Go to “Settlements” and then click on the period that you are curious about. You will see an overview, including a breakdown of all the fees you have been charged.

If you are still not sure what you have been charged for, please don’t hesitate to contact us at support@clearhaus.com. In case we charge you an authorisation fee, this will be deducted from your settlements on a monthly basis. This could be one of the reasons.

When you receive the status code 40400 Backend Problem, it means that the issuing bank (cardholder’s bank) does not respond to our request to process the transaction quickly enough. Visa/Mastercard give the banks a certain timeframe, within which they must respond to the request. If they do not respond within this timeframe, Visa/Mastercard will reject the transaction.

In some cases, the bank reserves the money on the customer’s card anyway, which is, of course, unfortunate. This is, however, neither Clearhaus’ nor your gateway’s fault. In this situation, the cardholder should contact his own bank and ask them to delete the reservation.

Whenever you do a refund, Clearhaus will charge you a small fee. So, whenever you process a refund, Clearhaus will deduct the refund fee from your next settlement.

Here is an example: A customer buys a product from you, the price is 10 euros. However, the customer regrets his purchase and returns the product to you. Therefore, you refund the customer 10 euros. When you do the refund, the 10 euros will be taken from your Clearhaus account and sent back to the cardholder’s account. Hereafter, Clearhaus will charge you, i.e. 0.25 EUR, for processing the refund.

Whenever you receive settlements from Clearhaus, you might be charged a settlement fee for this.

If you receive your settlements in DKK, you won’t get charged, but if you receive your settlement in any of our other settlement currencies, we will charge you a small fee.

For example, Clearhaus charges a fee of 3 EUR per settlement in EUR and 5 GBP per settlement in GBP. Therefore, we encourage you to consider this cost before choosing your settlement period with Clearhaus. We offer the following payout cycles: Daily (in special cases only), weekly or monthly. Read more on settlement periods here.

You can see if you are charged a settlement fee in your contract.

Tip: If you receive weekly settlements in GBP from Clearhaus, but your business would do fine with monthly settlements, you could save the settlement fee of 5 GBP three times a month. This adds up to 180 GBP in savings every year.

Clearhaus offers a variety of logos that our customers can download and show on their website. You can, for instance, find Apple Pay, MobilePay, Visa, and Mastercard logos. You can find the logos here.

Tip 1: Clearhaus requires that all our customers show Visa and Mastercard logos on their front page. You can either choose the logos we offer or find some official logos somewhere else.

Tip 2: When you show the logos for card schemes and payment methods on your website, you make your website more trustworthy. You can also advertise the various payment methods you support, which can be a bonus if your customers have a preferred payment method. It’s also good to let the customers know that they can pay with Apple Pay in case they’re shopping from their phone.

Not automatically, but you can set up email notifications in my.clearhaus. In my.clearhaus, click the three dots in the top left corner and then to “Notifications”. Here, you can select which notifications you want to receive, and you can choose which email the notifications are sent to. You can also choose how often you would like to be notified, i.e. once a day or once a week.

Tip: Receiving a chargeback is expensive and can be costly for your business. Therefore, it’s important that you take care of them. It’s highly recommended that you register at least one email to receive daily notifications - in this way, you’ll always be up-to-date with your disputes.

The capture will be processed as usual and you will get your money - even if the payment card expires, is lost or is stolen. In rare cases when the customer changes his bank between authorisation and capture, you cannot get your money. The customer’s bank, however, will have to act in good faith and try to collect the transaction before making a chargeback.

LATE CAPTURE: If your capture is made later than 7 days after the authorization, a late capture fee called “Late capture” will be applied. This fee is stated in your contract.

NOTE: The more days between the authorisation and the capture, the larger risk is for you to receive a chargeback reasoned with “late capture”. If the capture is made within 7 days, you cannot receive such a chargeback.

Captures can be made within 179 days of the authorisation; if it is 180 days old, it is too old.

If the authorization is to be voided, it must be done within 30 days after being made. After that, the possibility to void expires. However, this does not affect the possibility of making a capture up to the 179 days mentioned above.

Interchange fees are the costs we (the acquirer) pay the issuing bank. Interchange fees are set by the card schemes such as Visa and MasterCard.

Apart from the interchange fees from the card schemes, the merchant, who has an Interchange+ or IC+ agreement, also pays any other additional processing fees related to the transaction.

Finally, on top of that, we add our discount rate e.g. 0.5%.

You can sign up for a merchant account using our online application form. Here you will find the list with all the information required to be provided with a merchant account for a regular business.

If you are running a non-Danish company, a high-risk business, or a business that requires a license granted by a state authority, read this article for more information: What information do I need to provide to get a merchant account?

A gateway/PSP provides the payment window in your online shop and forwards the card information to the acquirer. The acquirer processes this information and makes sure that you will receive your payments. The acquirer collects the money from the cardholder’s bank account, store the money, and then deposit the money on your account.

A gateway is never allowed to hold the money. Instead, they are responsible for the technical set-up of features and payment methods, e.g. 3-D Secure and Apple Pay.

You can start accepting payments 1-3 days after you have submitted your application.

If you own a business that is considered of high-risk, or just have a particular business model, we may need additional time to assess your application.

This depends on your settlement period mentioned in the merchant agreement. Our standard settlement period is weekly, in which your money is paid out on Thursdays.

Read this article for more information: When do you pay out my money?

You can be settled in the following currencies: DKK, SEK, NOK, EUR, USD, GBP, CHF, CZK, RON, HUF or PLN)

Read this article for more information: Settlements

We accept transactions in all currencies supported by Visa and Mastercard.

See all currencies here.

Put simply, you need an additional merchant account if you:

For additional help, send an e-mail to: support@clearhaus.com

We offer acquiring services in the countries part of the EU27 or EEA.

This currently includes: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.

If the products sold in your new webshop is in the same category as the products sold in your current webshop and you want to receive your settlements from us in the same currency, you can use the existing agreement. You simply need to send us an email with your new domain name. Remember to include your customer number (MID) or company name.

If the new webshop is selling products in a different category or if you wish to receive the payments from the new webshop in a different currency you will need to make a new agreement with us.

You can search for different payment methods on my.clearhaus, i.e. searching for Apple Pay transactions. It’s done this way: ‘method:applepay’

You can also review our documentation on how to search for different things on my.clearhaus right here.

You can search for different payment methods on my.clearhaus, i.e. searching for MobilePay transactions. It’s done this way: ‘method:mobilepayonline’

You can also review our documentation on how to search for different things on my.clearhaus right here.

In your gateway’s control panel, you are able to manage your transactions and decide on the status of each transaction. In my.clearhaus.com, you can find a description of each of these transaction types/statuses, so you can understand the current payment status of a transaction.

Authorisation: this refers to the very first stage of a payment. In this stage, the card issuer decided whether or not the transaction can be processed. For example, they check if the cardholder has sufficient funds, if the card is valid, if the card is reported as lost or stolen, and so on. Once this process has been successfully completed, you can start to process the order. Please note that in this stage, your money is simply reserved on the cardholder’s bank account. For the money to be transferred to your merchant account, you need to make a capture.

Capture: when the authorisation has successfully been completed and the order has been processed (for example, you have shipped the goods), you can withdraw the money from your customer’s bank account. This process is called ‘capturing the money’ and you need to perform the capture in your gateway’s shop module.

Refund: in some cases, you will need to return the money to the customer after it has successfully been captured. This might be because the customer has returned the product or if the product was faulty upon arrival. If you wish to return the money, either the full transaction amount or only part of it, you need to make a refund in your gateway’s shop module.

Void: a void is a cancellation of an authorisation. It is basically the opposite of a capture, and it means that the money you have reserved on the customer’s bank account will no longer be reserved.

Credit: this is a transaction type/status only used for specific accounts and industries. After you have successfully authorised and captured the funds, you might have some receivables that need to be paid to your customers (for example rewards). You do this by crediting your merchant account. This is done in your gateway’s shop module.

Yes, we offer our contracts in 4 different languages:

To find your contract, go to www.clearhaus.com, click “Log in” and then go to “My Application”. In the top right corner, you can see a flag. Click the flag to change the page you’re looking at to another language.

If the owners remain the same, the existing agreement needs to be updated with the new registration number, business name, and business format. Please contact us at support@clearhaus.com, and we’ll update the information for you.

Note: This can only be done if the business operates as usual.

If the business has gotten new owners, they must submit a new application. A merchant agreement cannot be handed over to someone else.

The data can be found in your my.clearhaus. You find it by going to “settlements” and selecting the time period that you are interested in. You can then export the data from the settlement overview. This should be what your accountant is asking for.

Tip: In general, we advice you to invte your accountant to my.clearhaus, so they can extract the data they need themselves. Here’s a guide on how to invite someone to your my.clearhaus platform.

At Clearhaus, you will not receive invoices. We don’t send statements to you, but you can find a complete overview of your fees, transactions, and costs on your my.clearhaus platform. To find this, you need to:

If you, instead, wish to view fees for each transaction in the chosen period, you can see this in the exported settlement overview and transaction list.

We are very sorry to hear that you are leaving us.

In order to close your account you have to send us an email with customer number (MID) and company name or CVR-number. You cannot terminate your account over the phone, as it is important that we get this information in written form.

When an order is placed in your online shop, it automatically reserves the money on the customer’s card. In order to withdraw the money from the customer’s card you have to make a capture in your shop module or in your gateway. You are not allowed to do this before you ship the order.

Note: We settle your accounts weekly (unless otherwise agreed). Usually you will receive your payments Thursday, sometimes Friday. In case of public holidays, you may receive your money later than usual.

You can find your merchant identification number (MID) in the top left corner of my.clearhaus, right under your company name.

The merchant identification number is a 7 digit number. Example: 2000001

Most Clearhaus contracts have a capture limit. This capture limit can, for example, be €6.500 over 30 days. It does not mean that your customers can’t pay if you hit the €6.500 turnover limit in less than 30 days. What it does mean is that you can’t capture the money before Clearhaus has raised your limit or you get below €6.500 in 30 days. This is purely for safety reasons, so we can reduce the risk of fraud - both for you as an online shop owner and for us as an acquirer.

We continuously monitor your capture limit, but if you reach it, it’s important to contact Clearhaus. Please note that captures that occur later than 7 days after the authorization is made will be subject to a late capture fee regardless of the reason for the late capture.

Payments can fail for a lot of reasons.

The first thing to do is to go to your my.clearhaus platform and find the declined transaction. You can find all your transactions by clicking on “transactions” on top of the platform. If you cannot find your failed transactions in my.clearhaus, the mistake has happened at your gateway. In this case, please refer to your gateway.

If you find the failed transaction in my.clearhaus, you will be able to see a status code (the “Status” column). For failed transactions the code will be red. If you hover your cursor over the red code, a reason code will show. This will tell you why your transaction has failed.

Here’s a complete list of our reason codes:

| Code | Description |

|---|---|

| 20000 | Approved |

| 40000 | General input error. Card data is outdated or too old. You should ask the cardholder to create a new series. |

| 40110 | Invalid card number |

| 40111 | Unsupported card scheme (we only support Visa, Mastercard and Maestro) |

| 40120 | Invalid CSC |

| 40130 | Invalid expiry date |

| 40135 | Card expired |

| 40140 | Invalid currency (list of our supported currencies) |

| 40150 | Invalid text on statement (the descriptor you used for the transaction is not the one approved by Clearhaus) |

| 40190 | Invalid transaction (e.g. is you’re not allowed to do credit transfers) |

| 40200 | Clearhaus rule violation (we set up specific rules for transactions in your webshop, contact support to clarify the rules for your agreement) |

| 40300 | 3-D Secure problem (from the issuers side) |

| 40310 | 3-D Secure authentication failure |

| 40400 | Backend problem (issuing bank is not responding to approve the transaction) |

| 40410 | Declined by issuer or card scheme (can be for various reasons, cardholder needs to contact his bank to find out why) |

| 40411 | Card restricted (restrictions put on the card by issuing bank, e.g. it is not allowed to be used abroad) |

| 40412 | Card lost or stolen |

| 40413 | Insufficient funds |

| 40414 | Suspected fraud |

| 40415 | Amount limit exceeded (on the card, e.g. credit limits) |

| 40416 | Additional authentication required. Cardholder’s bank is requesting further/more authentication (Cardholder can contact their bank to get information about this) |

| 40420 | Merchant blocked by cardholder. Cardholder has blocked your online shop from deducting money on their card |

| 50000 | Clearhaus error (glitch in system, contact us for more information) |

3-D Secure is an additional security level that protects your business from fraudulent transactions.

By using 3-D Secure, the liability for chargebacks caused by fraudulent transactions shifts from your business to the cardholder’s/customer’s bank (issuing bank).

Apple Pay is Apple Inc’s digital wallet. Apple Pay is available on all newer iPhones, iPads, Apple Watches, and Macs. When you register your payment card in the wallet app you can pay by using fingerprint or Face ID. You can pay with Apple Pay in both online shops, apps and as contactless payments i physical stores.

Read more about Apple Pay.

Yes, we do support Apple Pay payments. However, you must have a payment gateway that also supports Apple Pay.

QuickPay, PensoPay, and Paylike support Apple Pay.

Apple Pay is connected to a credit or debit card, so when a customer pays with Apple Pay in your store, Clearhaus will charge you the standard fee for a card payment. For example, if the customer’s card is issued in the same country that you are located in, we will charge you 1.45%, which is the standard fee for domestic transactions - also if the payment is made with Apple Pay.

However, even though Clearhaus does not charge extra for Apple Pay transactions, your gateway might. They can charge either a monthly fee or a per-transaction fee, but this has nothing to do with Clearhaus.

MobilePay is a mobile-based app payment method offered by Danske Bank.

Read more about MobilePay here.

A descriptor is the text shown on a cardholder’s bank statement that describes a particular payment. The descriptor must help the cardholder identify the company/website on which the payment was made.

The merchant descriptor is defined when the merchant account is established, and is usually set as the website domain name/URL (e.g. my-shop.com).

Read more about descriptors here.

Send an e-mail to support@clearhaus.com and let us know why you would like to change your descriptor.

Remember that the descriptor must identify the merchant/website that initiates a transaction.

MobilePay is connected to a regular credit or debit card, so when a customer of yours purchases goods in your store through MobilePay, you will only be charged the normal percentage that you would be charged for that specific card.

In example, if a customer of yours purchases on a card issued in the same country as you are located, Clearhaus will according to the standard price list charge you 1.45% of that specific transaction. Therefore, you won’t be charged anything extra, just because the cardholder purchases with the MobilePay payment method.

Be aware, that your gateway may charge you extra to use and process this payment service. This has nothing to do with Clearhaus.